Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

Mountain Adventure Property Investments, LLC

P.O. Box 774406, 3150 Ingles Lane

Steamboat Springs, Colorado 80477

What was to initially be the partners. -

|

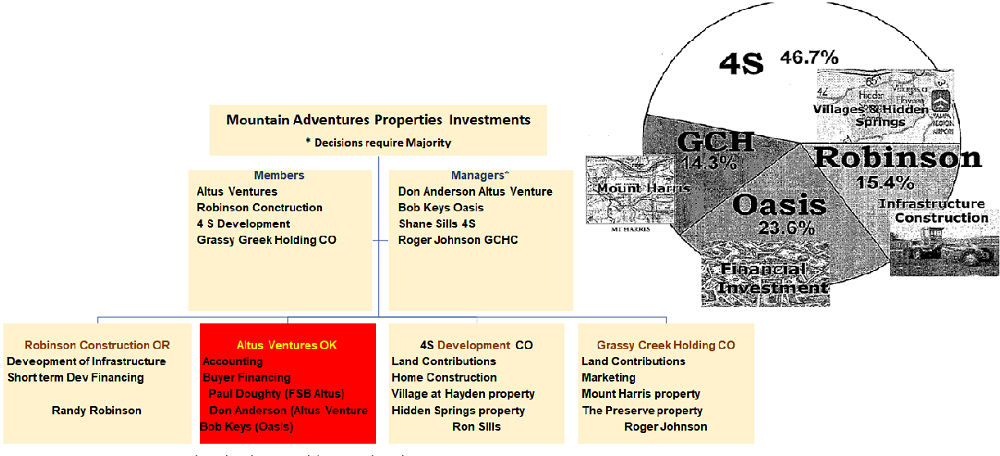

Roger Johnson, manager of Grassy Creek Holding Company, LLC (GCHC) and a manager of Mountain Adventure Property Investments, LLC located in Steamboat Springs. Ron Sills, a partner, controls 4S Development, Ltd. (4S), the current President and CEO for Mountain Adventure Property Investments, LLC. Altus Venture, LLC a subsidiary of an FSB Bancorp Altus Oklahoma (FSB Altus). That soon start to change in several significant ways.

|

In April of 2006, Mr. Sills and Mr. Johnson agreed to a joint-venture with Altus Venture, LLC. Together with Altus Venture, LLC, 4S and GCHC formed a new company called Mountain Adventure Property Investments, LLC (MAPI). The agreement with Altus Venture was that 4S and GCHC would incrementally contribute land to MAPI, and Altus Venture would provide the Capital and debt financing for MAPI to develop and sell that land (contained within three different developments) as finished homes and home-sites.

Further, Altus Venture would, in cooperation with First State Bank Altus, handle accounting, on-going financing, tax reporting, and all other fiscal matters of MAPI by utilizing their own resources and the services of their own in-house CPA, Bill Grissom, and Bill's staff.

Altus Venture, at the first company meeting in April, immediately proposed that Robinson Construction be engaged as the heavy equipment contractor, and should receive an ownership interest in MAPI in exchange for carrying short-term development financing through Robinson's credit lines, and by providing services at a reduced cost.

Already Mr. Sills and Mr. Johnson were being asked to give up more ownership interest in exchange for financing that Altus Venture was supposed to provide. Nonetheless, GCHC and 4S elected to go forward, and in July of 2006, MAPI began operations.

Robinson Construction began earth-work at the Hidden Springs Ranch, The Villages at Hayden, and Mt. Harris projects on land owned and partially improved by GCHC and 4S. The acreage contributed to MAPI at this point was approximately 805 acres by GCHC and 775 acres by 4S.

The ownership configuration of MAPI and responsibilities of the owner are as follows:

According to filings and supplemental information sales of finished lots at the Mt. Harris and Hidden Springs Ranch, projects began in October of 2006 in order to generate Capital. 18 thirty-five acre lots at Mt. Harris were sold over the following 8 months at an average price of about $675,000 for a total of approximately $12,150,000. Five five-acre lots at Hidden Springs Ranch lots were sold at an average of about $185,500 for a total of approximately $927,000. 10 Villages at Hayden lots were sold at an average of about $50,000 for a total of approximately $500,000. Combined gross sales over the three projects totaled approximately $13,577,000. In addition to proceeds from these sales, another $13,500,000 (approximately) was taken in by MAPI, 4S, and GCHC in loans from Vectra Bank and FSB Altus with which to pay off underlying debt and pay project expenses. The total cash thus generated between sales and loans was approximately $27,000,000 from July 2006 thru July 2007.

Altus Venture and FSB Altus, having taken responsibility for bookkeeping, accounting, payroll, and taxes, had invoices and receipts for development expense sent directly to Bill Grissom's office in Altus, Oklahoma from Robinson Construction. While 4S and GCHC repeatedly asked for summaries of project expenses, they were continually assured that they would receive records that never arrived.

It was apparent by July 2007 to 4S and GCHC that Altus Venture had made numerous management decisions without the managers approval, had very probably misappropriated MAPI funds, and was incapable of honoring their commitment to provide funding. Some of this information surfaced as a result of information received by 4S and GCHC from an investor associated with Altus Venture. 4S and GCHC were directed by this source to review information available by searching "Altus Venture" on the internet.

On August 2, 2007, 4S and GCHC (being majority owners of MAPI) convened a MAPI member meeting, at which additional managers were elected. A manager's meeting, including the new managers, was then held, and a resolution made to initiate a full audit of the MAPI books and to review all documents, contracts, transactions, invoices, and financial records previously not disclosed to 4S and GCHC. The purpose of these actions was to determine if there had been mismanagement of funds by Altus Venture, and if so, the nature, scale, scope, and probable effect of any such mismanagement.

Within 7 days after the appointment of additional managers, 4S and GCHC secured the MAPI offices in Steamboat Springs used by Altus Venture and Bill Grissom and obtained control of the computer server containing company records (which had been password-coded) not previously available to 4S and GCHC.

Within 2 weeks after the appointment of additional managers, Don Anderson and Bob Keys of Altus Venture resigned as managers of MAPI. Within 3 weeks after the appointment of additional managers, Robinson Construction filed construction liens on all three projects in the aggregate amount of approximately $5,000,000...$1.4 million against the Villages at Hayden, $700,000 against the Hidden Springs Ranch, and $3.0 million against Mt. Harris.

Having a computer expert access, the server enabled 4S and GCHC to review hundreds of documents and pages of correspondence between the principals of Altus Venture, First State Bank Altus, Bill Grissom and others associated with the project. Over the last 4 months, (September thru January) additional documents have been obtained, including bank records, bank statements and checks; promissory notes, e-mails; and title company closing documents which indicate some, if not all, of the following, may have occurred:

-

Bank Fraud. Investors/buyers, associated with Altus Venture, bought Mt. Harris lots making 10% down-payments (ranging from $63,000 to $72,500). MAPI carried back second mortgages at closing for an additional 10% of the purchase price. Bank financing (primarily through First State Bank Altus) was obtained for 80% of the purchase price. After obtaining bank records, 4S and GCHC discovered that these investors/buyers were rebated their down-payments without MAPI managers' knowledge or consent. Buyers introduced to Mt. Harris project through 4S or GCHC did not receive a "rebate." This aggregate "rebate" amount totaled some $720,000. This money belonged to MAPI and was not authorized as a rebate.

-

Bank Default/Fraud/Predatory Lending. On April 26, 2006, First State Bank Altus made a loan to 4S in the amount of $9 million, of which only $4.8 million was dispersed. The collateral value of this land parcel, which secures this loan (by appraisal), is currently $22 million. This created three problems...by design (Mr. Sills and Johnson stated they believed):

- Not only was the balance ($4.2 million) of the loan not funded by First State Bank Altus as agreed, thus hindering efforts to develop, build and deliver marketable product and thereby generate revenue (at one time Mr. Sills and Johnson stated they had numerous purchase reservations in The Lake Village, 15 of which had been converted to contract and the majority have since been canceled), also;

- The First State Bank Altus loan tied up the collateral that would have otherwise been available to obtain financing elsewhere, and;

- If the balance of the First State Bank Altus loan had been funded, it is reasonable to assume that even without closed sales, funds would be available to pay vendors; make interest payments; retire Vectra Bank debt, pay off liens (bogus or not) and otherwise remove obstacles to delivering finished product to our customers.

4S and GCHC contend that First State Bank Altus, Altus Venture, and Robinson Construction conspired to create a default position by withholding loan proceeds and filing fraudulent liens in order to take over the assets of 4S and GCHC. It is common knowledge that a default position makes it very difficult to obtain replacement financing. GCHC and 4S do have written communication between the aforementioned members of MAPI that provides evidence of such a conspiracy.

-

Unauthorized Accounts/Embezzlement. While Mr. Sills and Johnson said they cannot be certain as to the exact status of these accounts at this time, it appears that an account was established at First State Bank Altus in Oklahoma under the name of "Grassy Creek Development" (which company does not exist) to which deposits were made from MAPI land sales but which were used by Altus Venture without knowledge or consent of GCHC, whose only account is at Alpine Bank in Steamboat Springs, Colo. A MAPI bank account was apparently established at First State Bank Altus and used by the principals of Altus Venture without the knowledge or consent of the

managers. A 4S account was established at the First State Bank Altus in Oklahoma from which both Bill Grissom and Don Anderson signed checks even though they were not authorized signatories on any 4S account.

- Predatory Lending. Altus Venture/First State Bank Altus were in control of the finances for MAPI, which included payment of the Robinson Construction invoices. After the appointment of additional managers in August 2007, even though by then some $27,000,000 in sales and loan proceeds had been generated (not including the $4.2 million portions of the loan mentioned above that was withheld) First State Bank Altus and Altus Venture apparently encouraged the filing of liens on Villages of Hayden, Hidden Springs Ranch and Mt. Harris by Robinson Construction on all of MAPI's finished product, thereby eliminating MAPI's ability to generate sales revenue.

First State Bank Altus knew that all of the Robinson Construction cost had been paid for at The Villages at Hayden. It was the responsibility of First State Bank Altus and Altus Venture to pay these invoices, and they had the payment records at the time the liens were filed.

4S and GCHC have recently been able to obtain (and provide to legal counsel and lenders), copies of all canceled checks, lien waivers, and other evidence that the Robinson account was paid in full, and more (since some of the work paid for was not completed). Since Altus Venture hired Robinson and was adamant that Robinson be made a partner in the Venture; and since Altus Venture/FSB Altus controlled the financing and distribution of funds and proceeds, this begs the question...why would the Robinson account not be paid in full, and if not, why would Robinson, a partner in the Venture, damage his own company by filing liens? The answer (in the opinion of 4S and GCHC) is that this action was a transparent attempt to force 4S and GCHC to transfer another 1000 acres (4S) and 3200 acres (GCHC) into MAPI and forgive the FSB Altus Ventures/Altus Venture indiscretions. By eliminating MAPI's ability to sell lots (numerous homes and lots were under contract), obtain construction financing, or refinance development loans, Altus Venture/FSB Altus effectively crippled a perfectly viable business forcing loan defaults.

In the last 3 days, GCHC and 4S were told by two different lender/investors (who had represented they were able to provide replacement financing for MAPI, 4S and GCHC to pay off the liens and bank loans) that Altus Venture had communicated with them that "MAPI, 4S and GCHC were down the tubes and Altus Venture would be taking over the projects," and further insinuated that for these lenders/investors to get involved with MAPI, 4S, or GCHC would mire them in legal actions.

Up until the first week in January, it was represented by FSB Altus, that the bank was fully behind the refinance efforts by GCHC and 4S on behalf of MAPI and its members, when in fact, FSB Altus, Altus Venture and Robinson Construction have (in the opinion of 4S and GCHC) taken extreme efforts to hinder production and sales, to force loan defaults, and to obtain MAPI, GCHC, and 4S assets for their own enrichment. Further, the purpose of these actions seems to be to prevent their other (unethical/illegal practices and actions) from coming to light under GCHC and 4S management and third-party oversight.