Like the 3,200 other pages of evidence uncovered and descriptions of crimes on this site, this web page is only one part of a massive multi-state entanglement of government corruption and cover-up. See size

Evidence was uncovered in parts over years, and not in the same order as the crimes occurred or the evidence was created. Statements were made based on what was known at the time.

Dates are approximate because government filings and reports vary in some cases up to months if not This is part of cover up. One example is Oklahoma's Openbooks, which started out late with only a fraction of what was required to be added each year. Plus, the data was littered with data entry and spelling errors, meaning you have to go through one entry at a time. This amount to more than 17,000 entries in 2017.

Re: Oklahoma Investment/New Jobs Credit 68 § 2357.4

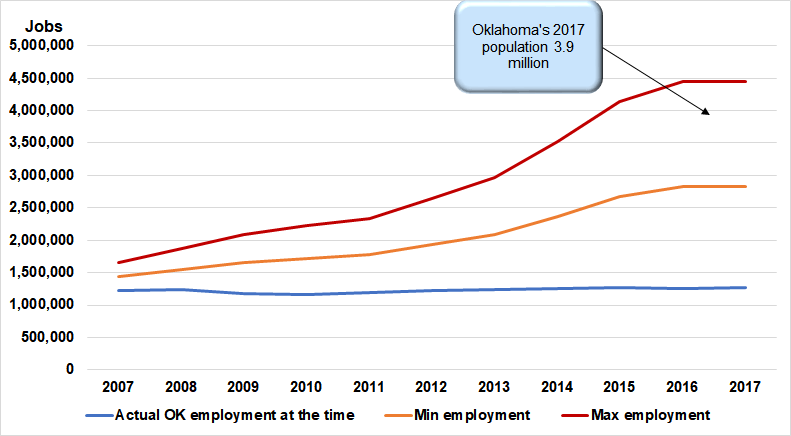

Actual Oklahoma Employment v Jobs that would have had to be created based on the amount uncovered for tax credits allowed for one of Oklahoma's sixty-three hidden tax credits.

68 O.S. §2357.4 Oklahoma Investment/New Jobs Credit, which allows

- For investments is less than $40 million $500 in tax credits for each new job created or 1% of funds invested. Max employment (cumulative).

- For investments more than $40 million $1,000 in tax credits for each new job created or 2% of funds invested. Min employment. (cumulative).

- This is one of Oklahoma's oldest tax credits and there is no information other than the amount of tax credits taken or cost to the public.

- The smallest in terms percent of investment allowed for tax credits, yet the largest total tax credits reported to have been allowed.

- We have other tax credits 68 § 2357.62 and 68 § 2357.73 reported as 68 § 2357.4 tax credits.

The amounts can be seen Oklahoma's Datagov Tax Credits. Note: https://data.ok.gov/dataset/state-oklahoma-tax-credits (OpenBooks) was not reported until after the 2009 cover-up, and then caught in parts over several years. Keep in mind there was no documentation or records of tax credits used.

Source for Oklahoma's employment. Bureau of Labor Statistics.